Are you struggling to regain control and get back on track with your finances? Life can throw unexpected curveballs, making it easy to veer off course when it comes to managing your money. But fear not! In this comprehensive step-by-step guide, we’ll show you how to get back on track with your finances using a powerful tool – a savings calculator.

Whether you’re recovering from a financial setback or simply want to boost your savings, this step-by-step approach will help you make informed financial decisions and pave the way towards a brighter financial future.

Personally, I want to be less reliant on my full time job and be in a comfortable position to be able to travel more. My dream is to work part time and have a side hustle income to see me through.

Step 1: Assess Your Financial Situation

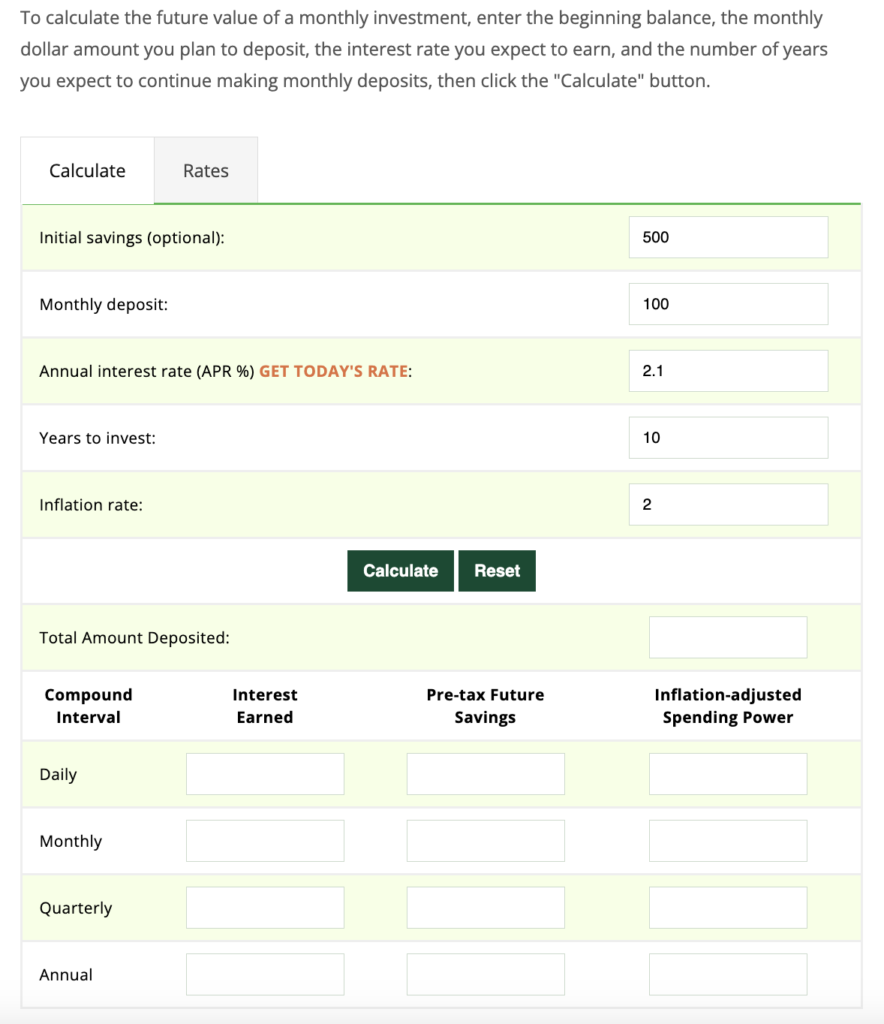

The first step in getting your finances back on track is understanding where you currently stand. Gather all your financial statements, including bank statements, credit card bills, and any outstanding debts. Then, use a savings calculator like this to input your current financial details.

This will give you a clear picture of your financial health and help identify areas that need improvement.

Step 2: Set Clear Financial Goals

Now that you have a snapshot of your current finances, it’s time to set clear and achievable financial goals. Ask yourself what you want to achieve – whether it’s building an emergency fund, paying off debt, or saving for a specific goal like a vacation or a new home. Use the savings calculator to estimate how much you need to save each month to reach these goals within your desired timeframe.

Step 3: Create a Budget

Creating a budget is essential to ensure you stay on track with your finances. Using the savings calculator, input your monthly income and estimated expenses. This will help you determine how much you can allocate to savings and identify areas where you can cut back if necessary. Stick to your budget religiously to ensure your financial goals become a reality.

Step 4: Automate Your Savings

One of the easiest ways to build your savings is by automating the process. Set up automatic transfers from your checking account to your savings account using the insights gained from the savings calculator. This ensures that you consistently contribute to your savings goals without the temptation to spend the money elsewhere.

Step 5: Reduce Unnecessary Expenses

To boost your savings and get back on track financially, it’s important to trim unnecessary expenses. This can be anything from TV streaming services you don’t use to switching supermarkets in order to bring your food expenses down.

Review your monthly expenditures and identify areas where you can cut back. The savings calculator can help you estimate how much these cutbacks will add to your savings over time, motivating you to stay disciplined.

Step 6: Pay Off High-Interest Debt

High-interest debt can drain your finances and hinder your savings efforts.

Use the savings calculator to see how much interest you’re paying on your outstanding debts. Create a debt repayment plan, focusing on paying off high-interest debts first. As you reduce your debt, you’ll free up more funds for savings.

Step 7: Monitor Your Progress

Regularly monitor your progress and savings goals using this calculator. Update your financial information as needed to ensure you’re staying on course to meet your goals. Celebrate milestones along the way to stay motivated and make adjustments if necessary.

Conclusion

Getting on track with your finances is achievable with the right tools and strategies. By using a savings calculator to assess your financial situation, set goals, and create a budget, you can regain control of your finances and work towards a secure and prosperous future. Remember, consistency and discipline are key to financial success. Start today, and watch your financial dreams become a reality!